On Line

Skype+MSN

+5493413351427

+54-341-4212091

+5493413351427

RSS

Support Form

ITR for Samrtphones

Tweets por el @ITRSoluciones.

Point of Sales Products

Fiscal Printers

For the Approved 4104/97 AFIP-DGI, Requeired to all "Responsables Inscriptos" on TAX (IVA) to inlude Tax Printers.

ITR Official support: Grupo Hasar / Epson / Samsung / SAM4S

CONTACT US TO RESELL OR DISTRIBUTE THE SECOND GENERATION SOFTWARE FOR PoS

Contact Form

Software PoS

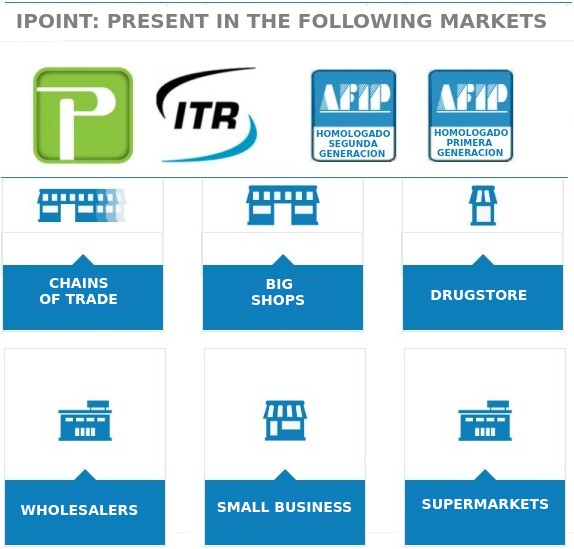

IPOINT, PoS FISCAL BILLER

IPOINT PoS was designed to meet the needs of all retail stores that require a flexible, easy to install and intuitive to use and learn. The IPOINT PoS system is the perfect solution for small businesses and small companies needing a solution for point of sale and merchandise management. This system based on Windows graphical environment, with database engine license free resolves beyond the requirements according to the latest billing rules, the possibility of controlling stock of merchandise, inventory and customer accounts . In addition to this fully automated facility, the excellent graphical interface and documentation that enable the user to immediately begin operating the system and its low cost, make a product I-POINT elected by the majority of small businesses seeking general classes of control business beyond just billing. The system is compatible with the entire line of Tax printers Hasar & Epson

ITR, Partner & Support of IPOINT Software

IPOINT PoS

Features

IPOINT POS takes into account all the needs of your business. Knowing the great rotation on the premises, the software is extremely easy to use and has permits and controls that give you total security.

Security

The client/Server desing, offer strong security, direct data access to de server,

Support

Support of Grupo Hasar, more than 10 years experince in IPOINT customer support.

HASAR, more than 50 years in the point-of-sale market

Interface: Easy & Friendly

The friendly interface of the system and the logical order in which the menus are intuitive favor of software. To install IPOINT has a wizard that will guide you step by step to avoid any inconvenience at this stage. Full integration between modules allows you to enter data in a transaction only once. Thus avoiding a double burden of data and making more efficient use of the resources of your business.

Licence Form

Demo

Electronic Invoicing

Argentina is one of the Latin countries that put electronic invoicing into practice. Based on Government rules and regulations, there are many differences between eFactura and for instance Brazil\92s Nf-e (Nota Fiscal Eletronica). The law in Argentina obliges every company that deals with VAT related invoices to generate these documents in the electronically:

Invoices or equivalent documents class A Credit notes and debit notes class A

Companies have the option to create the electronic version of the documents below:

Invoices or equivalent documents class B Credit notes and debit notes class B

This fiscal program has started in 2006, and it it took the Government a great deal of time and effort to make it mandatory. The number of commercial channels and communication methods were other aspects that made the implementation take so long. Moreover, the implementation proves to be a slow growing trend as the level of validation over the XML file sent to AFIP is not high.

In order to issue an electronic invoice (eFactura), the companies must request a digital certification called Fiscal Key. Using this fiscal key, the company is an electronic issuer. Then, the company will request authorization to issue each separate invoice. This authorization is requested to AFIP (Administraci\F3n Federal de Ingresos P\FAblicos), the Government Tax Entity. An electronic certification number called CAE proves that the authorization is official. Without the CAE number applied to the invoice, it is not possible to release invoices to customers.

This CAE number can be gathered in two ways:

\96 Normal: the communication method does not matter, every invoice should have one

\96 Anticipated: the company can ask for a certain number of CAE numbers according to its wish, for 15 days. After this period, the company has to file a report on how many of those numbers were really used. Optionally,they can make a request for more.

Another determining aspect when configuring a company\92s scenario in eFactura is the regime. A regime determines the tax contribution model that applies to the company.

Two major ones are:

R.E.C.E. \E0 Regime de Emissi\F3n de Comprobantes Electr\F3nicos \96 This is the most adequate model for large contributors. It is based on web services, with no limits

R.E.C.L. \E0 Regime de Emissi\F3n de Comprobantes en L\EDnea \96 This modelv is very adequate for companies with no more than 100 invoices per month.

Gestion-Ventas - Electronic Invoicing

Ventas gives you the opportunity to comply with regulations, issuing electronic invoices through direct communication with webservices AFIP, no extra costs

Support

Sopported by Axoft Argentina SA, the market leader in management software, is the result of experience over 20 years collecting suggestions from our customers, always incorporating competitive advantages that have earned him several awards, becoming in software management and most awarded preferred by Argentine companies and professionals.

Licence Form

Demo